Energy storage is playing a critical role in ensuring rapid decarbonization and fighting climate change. Two sectors that have an obvious overlap are clean electricity generation and clean transportation. In both cases, storage technology has made huge strides. Over the past decade, as battery prices have reduced, we have seen a significant uptake of stationary storage systems across residential, commercial and utility-scale applications. Further, there has been no better time to purchase an electric vehicle. At the time of this writing, fuel prices are very high for geopolitical reasons. In addition, various countries are offering attractive incentives and subsidies, which will further bode well for the transition towards electric mobility.

At PVEL, we are witnessing a repeat of what happened a decade ago. As the solar market surged globally, we played an important role in the ecosystem to ensure we provide the data that matters – for better quality, procurement decisions and cashflow certainty. As a new era, dawns upon us, PVEL and Exawatt are excited to launch the Battery Technology and Cost Forecast report (BTAC).

What is BTAC?

BTAC is a biannual report for which PVEL and Exawatt have jointly developed a methodology that leverages bottom-up cost analysis, based on data gathered from more than 180 publicly traded companies throughout the lithium-ion cell supply chain, combined with a manufacturing model that contains over 100 input variables. Additionally, manufacturer top-down forecasts and industry trends across the past 5 years are incorporated into the model.

Cell costs are estimated by employing a bottom-up methodology that builds the cell from its BOM components capture all-inclusive costs incurred by suppliers in cell manufacturing. This analysis also considers cell-assembly location factors such as electricity rates and labor costs. Shipping is excluded as it varies widely between manufacturers, the source and the destination.

Lithium-ion battery cell Cost of Goods Sold (COGS) is estimated using component costs obtained from pure-play suppliers (i.e., manufacturers that specialize in producing one battery component), and from direct quotes and market price data. COGS is presented per generally accepted accounting principles (GAAP) guidelines, which include all cash costs (e.g., direct materials, consumables in production, utilities, etc.) and factory depreciation.

1. Supply Chain issues with Lithium

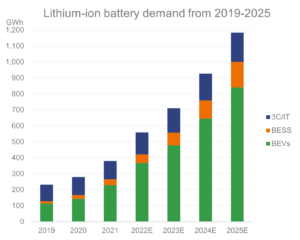

We expect Li-ion battery market demand to surpass 1 TWh in 2025, with Battery Electric Vehicles (BEVs) capturing 75-80% of that demand. At that time, we also expect demand from the Battery Energy Storage Systems (BESS) market to exceed the Computer, Communication, and Consumer Electronics/Information Technology (3C/IT) segment. Lithium carbonate equivalent (LCE) spot prices have increased by 5-6x across the past four quarters, due to high demand from BESS and BEV sectors outpacing the growth of materials extraction and refining capacity. Absent significant changes in lithium supply or reduction in demand due to changing BEV manufacturer strategies, we expect this deficit to remain until the second half of the 2020s at the earliest as further facilities are brought online. In November 2021, CATL and BYD, two of the world’s largest LIB cell and pack manufacturers, increased their prices by 10% and 20% respectively. Both manufacturers cited increases in raw material prices as the main factor for the rise. Picture 1 below illustrates Li-ion battery demand from 2019-2025. Lithium carbonate spot prices have increased $15/kg in Q3 2021 to over $70/kg, meaning cell manufacturers without pre-existing large-scale upstream lithium/CAM supply agreements will face significant cost challenges in the short to medium term (post 2025).

Source: Exawatt lithium-ion battery demand forecast

2. Lithium vs Others?

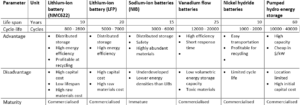

There are multiple parameters on which batteries can be assessed – some of these are cost economics, operating temperature range, safety, energy density, transportability and the availability of raw materials. Given these factors, several other storage technologies may compete with lithium-ion batteries. These include sodium-ion batteries (NIBs or SIBs), vanadium flow batteries, nickel hydride batteries and hydrogen. The choice of the technology largely depends on the specific use case of the end application.

3. Where do with stand with recycling?

With battery OEMs typically providing warranties of up to 8 years, we expect battery recycling to become an important discussion in the medium term. Better recycling practices will allow manufacturers to reduce outputs of toxic and flammable waste and to recover and reuse critically constrained materials. The typical recycling cycle involves three steps:

- Discharging – Batteries must be discharged prior to dismantling for safety reasons

- Mechanical Separation – Batteries are broken down to separate out the black mass from the casing and foils

- Recovery – The three common methods for recovery are: Hydrometallurgical (uses acids to recover metals after splitting batteries into composite parts), pyrometallurgic (uses high temperatures to recover metals), and direct processing (uses glycol solvent to get reuse of materials, rather than destructive recovery)

Next Steps

PVEL and Exawatt’s BTAC report helps project developers and investors assess the technology roadmap and supply/demand dynamics for the energy storage market.

- Ready to learn more? Contact PVEL to request a sample BTAC report or sign up as a subscriber.

About the Authors

Sishir Garemella is Head of International Business Development at PV Evolution Labs (PVEL). He is responsible for the company’s expansion in strategic global markets. Sishir is based in Delhi NCR and has over 10 years of experience as a downstream solar player, both as a financier and as an operator.

Edward Rackley is the leader of Exawatt’s energy storage vertical and is focused on using his electrochemical materials knowledge to inform Exawatt’s bottom-up cost modelling. He is based in Sheffield, England and has a PhD in Solid Oxide Fuel Cells. Previously, Ed has conducted industrial research into novel battery current collector materials and lithium-ion battery cathode synthesis.