Want a closer look at STAC? Join us for a webinar on February 6th, where we’ll cover more insights from the Q4 Report, including an opportunity to have your questions answered during live Q&A. Register here.

The end of 2022 and start of 2023 have offered no let up from the constantly shifting sands of the solar industry. Here we take a brief look at some of the key topics that are covered in depth in PVEL’s and Exawatt’s Q4 2022 Solar Technology and Cost (STAC) report.

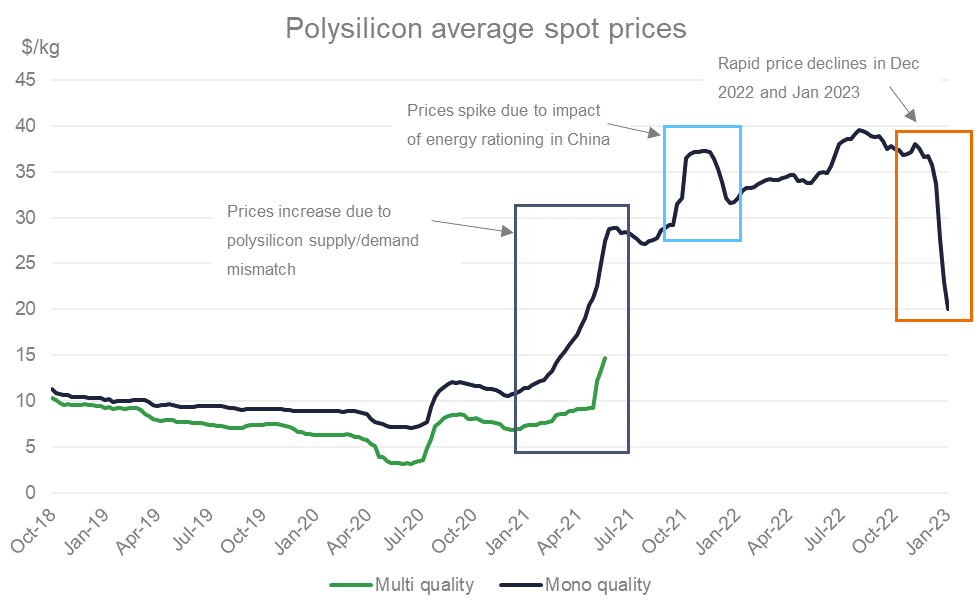

Polysilicon prices

After 18 months of exceptionally high prices and a tight supply/demand balance, polysilicon spot prices showed an aggressive decline in December 2022 and early January 2023. The price decline is widely expected to taper off in the coming weeks, with the recent aggressive decrease in part being driven by inventory clearances at the end of the year and a temporary lull in demand. However, price declines do also represent the impact of a large increase in Chinese polysilicon production: growing from ~62,000 MT in August 2022 to ~97,000 MT in December 2022.

For U.S. module buyers, there is a risk that price declines for polysilicon will be muted by an effective requirement to use poly produced outside of China in order to get modules through UFLPA enforcement. We believe that until recently, the price gap between China and non-China polysilicon has been approximately 5-10%, but that this may now be growing meaningfully as Chinese polysilicon prices decline. Non-China polysilicon capacity is discussed further in the full report.

Polysilicon spot prices declined rapidly during the final few weeks of 2022 and the first few weeks of 2023. While prices should now stabilise for a period, and may even rebound somewhat, Exawatt does expect further, more modest, declines later in the year.

TOPCon

In China the rapid shift to TOPCon that we have been forecasting is now underway as the manufacturing cost of TOPCon modules falls below that of PERC for leading manufacturers. Exawatt’s latest modelling suggests that module COGS for TOPCon and PERC may have reached cost-per-watt parity in late 2022 for some leading manufacturers, and that by the end of 2024, integrated manufacturers will be able to achieve a module COGS for TOPCon of ~0.6 ¢/W below that of PERC. Globally, TOPCon looks set to make up a significant proportion of 2023 shipments for several key manufacturers:

- Jinko has said that it expects >50% of its 2023 shipments to be TOPCon

- Canadian Solar and JA Solar have both stated that they expect >30% of their 2023 shipments to be TOPCon

- Based on cell capacity plans, we expect Trina’s 2023 shipments to be 20-25% TOPCon

By 2025 we expect TOPCon to take the largest market share of all technologies, and the Q4 STAC update covers forecasts for both market share and module manufacturing cost by technology.

While many new manufacturers continue to announce HJT capacity plans, the higher manufacturing cost for this technology means that capacity announcements lag behind its rival TOPCon. The gap in anticipated capacity between the two technologies has grown meaningfully in recent months, with TOPCon capacity now set to be around 2.6x that of HJT at the end of 2024 (up from 1.8x in our Q3 update).

AD/CVD

For U.S.-based module buyers, one key question around the recent determination in the AD/CVD circumvention case is whether module suppliers will find ways around the duties, in the same way that SE Asian manufacturing was established to side-step the original imposition of AD/CVD on Chinese cells.

Perhaps the most obvious option to enable imports from SE Asia (of both cells and modules) without paying AD/CVD is to use wafers sourced from outside of China. However, ingot and wafer manufacturing capacity outside of China and Taiwan is currently only ~15 GW, far too low to supply the U.S. market and far below cell capacity in SE Asia (>50 GW at the end of 2022).

In addition to the absolute lack of non-China capacity, the wafer capacity that does exist in SE Asia is almost all part of a vertically integrated manufacturing strategy in the region. With the bulk of planned non-China wafer capacity additions in both SE Asia and elsewhere also set to be part of integrated manufacturing strategies, there is likely to be a shortage in availability of non-China wafers for third-party buyers such as cell and module manufacturers in SE Asia.

Looking at alternative approaches to avoid module tariffs, manufacturers may aim to avoid sourcing more than two of the six components listed in the Department of Commerce’s preliminary determination from China, and so avoid module AD/CVD. Our preliminary investigations imply that non-China silver paste, glass, and encapsulant capacities are likely to be sufficient to serve the majority of the U.S. market in the medium term; however, there may be some shortages and there is likely be relatively limited room to manoeuvre due to limited surplus of capacity. With modest non-China frame supply, backsheet supply (where relevant), and junction box supply, it should be viable for most SE Asian manufacturers that are not able to access non-China wafers to align supply chains appropriately to avoid module AD/CVD. However, the supply/demand balances for these components are likely to be tight enough that this will not be trivial logistically, and we expect to see price increases for some of these non-China components due to the disruption resulting from the AD/CVD determination.

IRA

While the effects of the manufacturing incentives included in the Inflation Reduction Act will take several years to be fully realized, we have already seen ~35 GW of new module manufacturing capacity announced, and a similar volume is known to be under serious consideration but as yet unconfirmed.

Based on our bottom-up modelling, our broad conclusion is that even in a “high delta” scenario, where additional costs for U.S. manufacturing are at the upper end of what we consider likely, the manufacturing incentives included in the IRA would make integrated (ingot to module) manufacturing in the US cost-competitive with SE Asia and even China, at least while the full incentive is available.

Of course, being competitive on effective manufacturing cost (after incentives) is not the only consideration – manufacturers must also take into account considerations such facility payback times, the period of the incentives (due to begin phasing out in 2030), ease of access to capital, the risk that incentives could be altered, and risks that cost structures could change if import tariffs on input materials are altered. Further details of the likely U.S. manufacturing costs and key cost drivers for each step of the value chain are discussed in the full report.

What is the Solar Technology and Cost Forecast Report (STAC)?

STAC is a subscription-based service that aims to provide an informed forecast of PV module efficiency, form factor and price for a rolling quarterly window looking forward three years. Our methodology leverages bottom-up cost analysis, based on data gathered from over 100 publicly traded companies throughout the PV module supply chain, combined with a manufacturing facility operations model that contains over 250 input variables. PVEL and Exawatt also incorporate manufacturer-reported top-down forecasts and industry trends observed over the past 10+ years, as well as findings from PVEL’s testing for the PV Module Product Qualification Program.

Next Steps

PVEL and Exawatt’s STAC report helps project developers and investors assess the technology roadmap and supply/demand dynamics for the PV module market.

Ready to learn more? Contact PVEL to request a sample STAC report or sign up as a subscriber.

Want a closer look at STAC? Join us for a webinar on February 6th, where we’ll cover more insights from the Q4 Report, including an opportunity to have your questions answered during live Q&A. Register here.

About the Authors

Sishir Garemella is Head of International Business Development at PV Evolution Labs (PVEL). He is responsible for the company’s expansion in strategic global markets. Sishir is based in Delhi NCR and has over 10 years of experience as a downstream solar player, both as a financier and as an operator.

Alex Barrows is Head of PV at Exawatt, and is focused on forecasting the efficiency and cost evolution of solar technologies. Alex is based in Sheffield, England, and has a PhD in perovskite solar cells.